Remove the burden of tax compliance

Secure your organisation from ever-growing threats of financial and reputational insecurity. LANCE offers peace of mind through a simple and affordable solution to offshore structure providers. Request a free trialReport

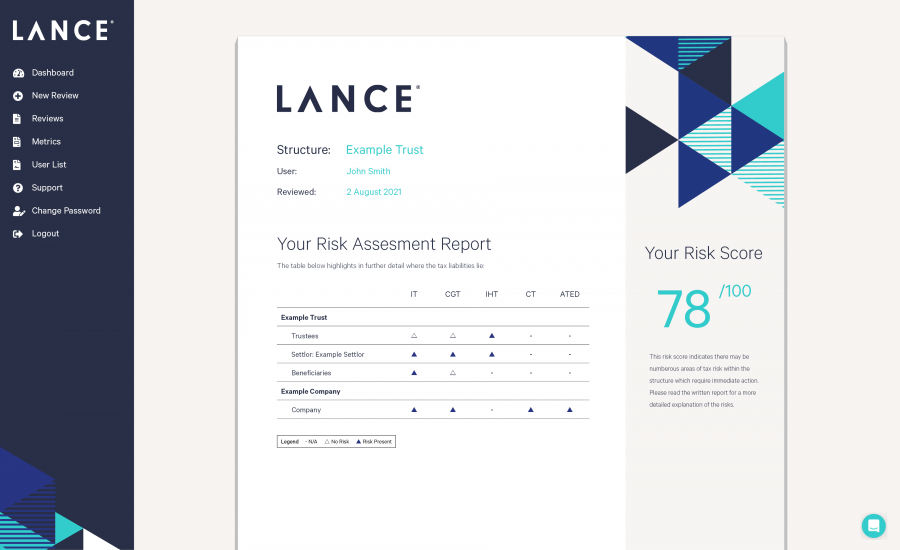

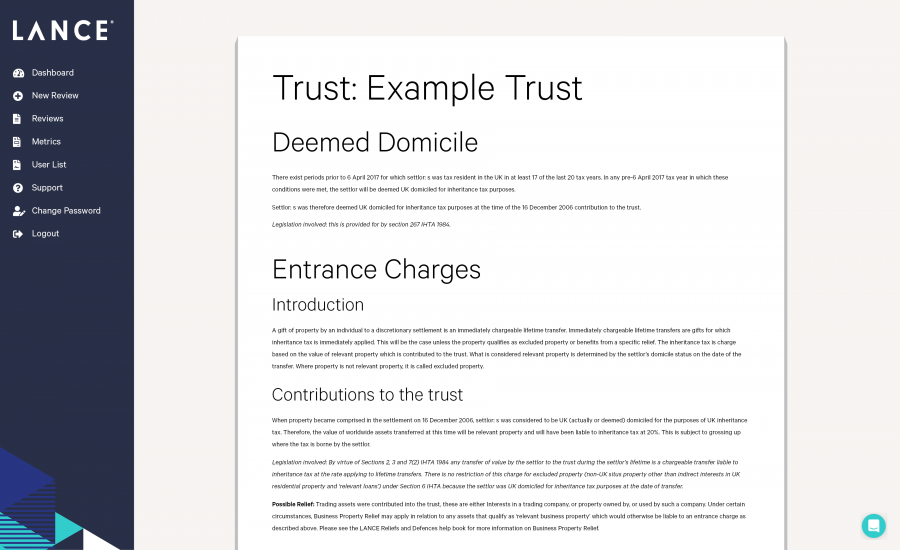

LANCE provides a quick indication of overall UK tax risk with a score out of 100, and a visual to highlight where risk areas and liabilities lie. A written report will then provide an analysis of tax areas and relevant legislation, saving time and costs by directing advice to the identified risk areas.

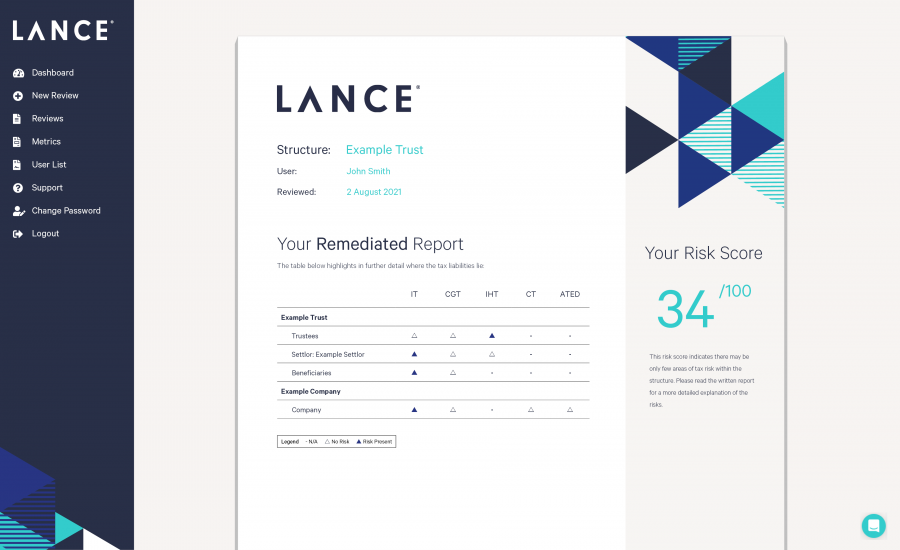

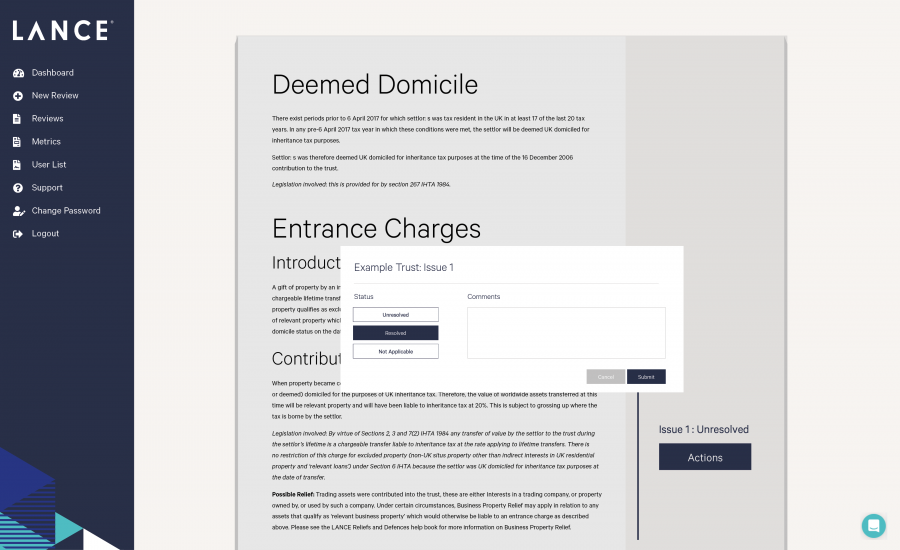

Remediate

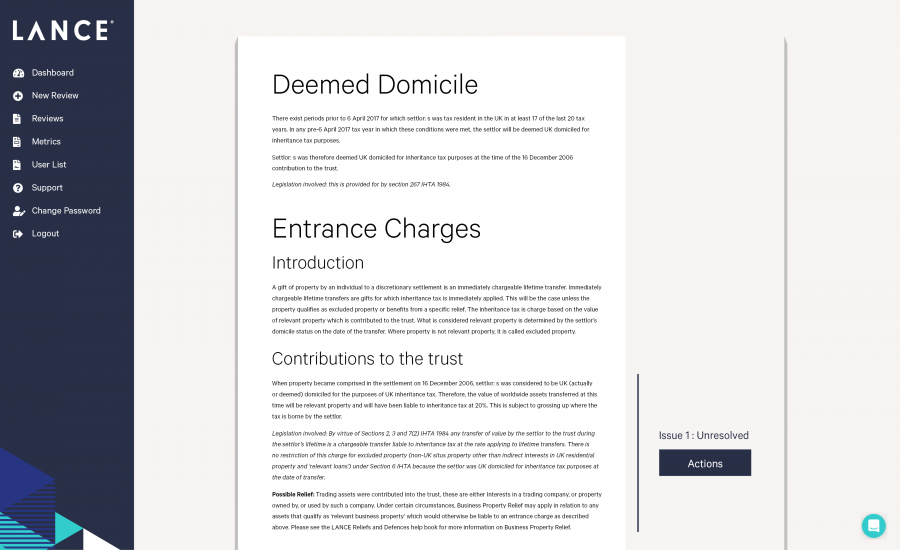

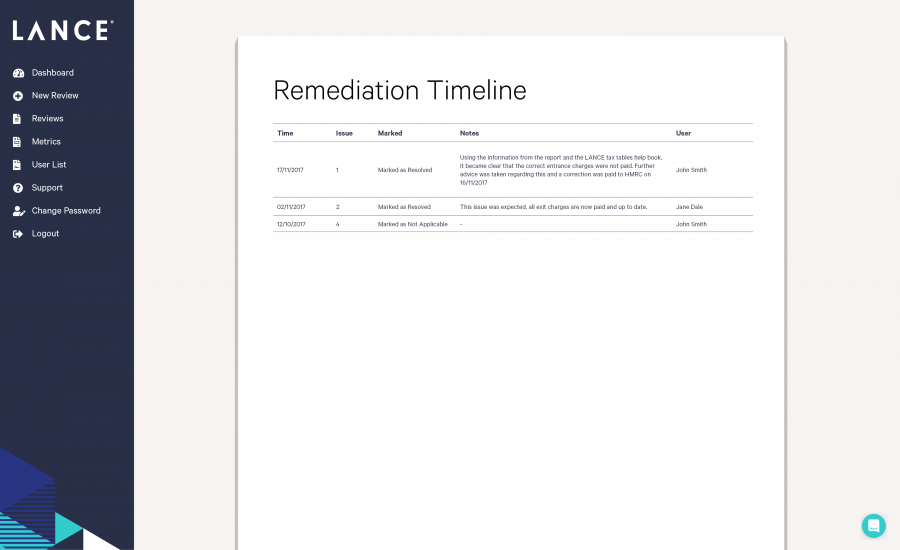

Our software allows you to remediate your score by ticking off the risk areas that have been dealt with, recalculating the risk to reflect the current status of the structure. A remediated risk score then gives you clarity and understanding of the areas of UK tax that need further review.

Record

We enable you to generate notes for every stage of the process. Once a risk area has been ticked off, you can then add comments to a table in the report to create a complete audit trail during the whole remediation process. This gives you an effective overview of workflow and illustrates ways to improve.

LANCE identifies current and historic tax risk as well as non-compliance for any offshore structure comprising Trusts and Companies.

Access our easy-to-use portal anywhere, anytime

Our cloud-based software provides an easy-to-use portal and review process to categorise tax risk into

- Income Tax

- Capital Gains Tax

- Inheritance Tax

- Corporation Tax

- Annual Tax on Enveloped Dwellings

Whitepapers

Download one of the following whitepapers on UK legislation and tax compliance.LANCE specialises in…

Transparency in the offshore financial world is in demand, and it is not limited to your current operations. Through internal assessment, you can identify previous risks and put in prevention methods to stop any issues from reoccurring.

Consistent evaluation of your offshore tax operation is the only certain way of ensuring compliance. Our software highlights incoming changes to help you respond to the constant pressure to remain up to date with increasing legislation.

Our system enables you to fast-track due diligence requirements, not only when acquiring trust companies or UK-connected client books, but also as part of any sale proposal. This demonstrates tax compliance, and can even be a price negotiation tool.

Regular updates following any relevant changes in UK tax law or industry practice reduce the need for you to amend your processes. We provide peace of mind whilst also enabling you to establish yourself as aware and compliant to both clients and regulators.

With access to high-level tax knowledge, our software can be used as a staff training tool on the essentials required for analysis and maintenance of offshore structures – breaking down the complexity of UK tax into step-by-step questions.

Our software grants insight into potentially overlooked areas of UK tax. Management tools enable you to analyse data and spot organisational trends. This data can then be used to monitor staff, accurately budget and identify training requirements.

The benefits of using LANCE

By identifying specific areas of UK tax risk which require further action, you have the ability to access targeted and more relevant tax advice, reducing compliance costs. Additionally, through training for staff and the ability to notice trends, you can reduce future errors and streamline internal processes.

With fast-tracked reviewing capability, your team can focus their attention on the onboarding and ongoing management of clients. Equally, with annual reviews being performed internally, there’s no need to communicate with external consultants and advisors.

LANCE users are well-equipped with documentation and ongoing support. With us, you are no longer wholly reliant on external tax advisors. Our system and guidance allows you the freedom to independently self-assess UK tax compliance.

A LANCE review does not require you to input any of your client’s personal or identifying information. As such, reviews are conducted with complete anonymity, giving you the utmost confidence that client data is safe.